Individual 401k contribution calculator

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

Investment Goals Investing Investing For Retirement Retirement Savings Plan

Dont Wait To Get Started.

. Ad Discover The Traditional IRA That May Be Right For You. Learn About Contribution Limits. Complete a Self-Employed 401 k Account Application for yourself and each participating owner including the business owners spouse if applicable.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. If your business is an S-corp C-corp or LLC taxed as such. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Enter your name age and income and then click Calculate The. Total contributions to a participants account not counting catch-up contributions for those age 50 and over cannot exceed 61000 for 2022 57000 for 2020. If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan.

Use the self-employed 401 k calculator to estimate the potential contribution that can be made. Ad Discover The Traditional IRA That May Be Right For You. Solo 401k Contribution Calculator 2020.

In 2020 the maximum contribution to an Individual 401 k is 57000 for individuals. Solo 401 k Contribution Calculator. Early withdrawals from retirement accounts.

Step 5 Determine whether the contributions are made at the start or the end of the period. 10 Best Companies to Rollover Your 401K into a Gold IRA. For SIMPLE and Individual 401 k plans you are able to make additional contributions known as Catchup Contributions if you are age 50 or older by the end of the year.

Retirement Trusts. Ad TIAA Can Help You Create A Retirement Plan For Your Future. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. It simulates that if you. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal.

Affordable easy payroll integrated. Protect Yourself From Inflation. Build Your Future With a Firm that has 85 Years of Retirement Experience.

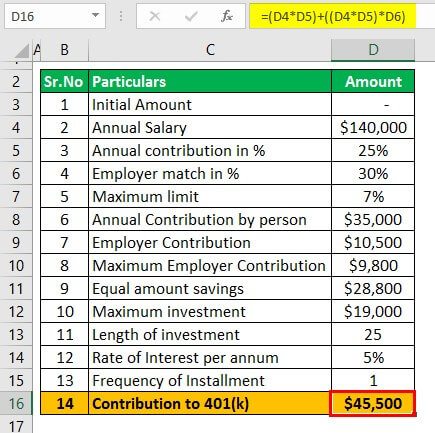

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 Contribution which would be maximum.

Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. Penelope makes it simple. Small business 401k plans with big benefits.

Build Your Future With a Firm that has 85 Years of Retirement Experience. An IRA or individual retirement account is a tax-advantaged account that savers open on their. Ad Attract and keep employees with 401k plans.

Each option has distinct features and amounts that can be contributed to the plan each year. Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan. This is the maximum amount you are allowed to contribute to your Individual 401 k account per year.

Step 6 Determine whether an employer is contributing to match the individuals. Use the Individual 401k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401k. Learn About Contribution Limits.

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Planner Early Retirement

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

401k Contribution Calculator Top Sellers 58 Off Www Seaforthland Com

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Retirement Planning Good Credit

Retirement Planner Spreadsheet Retirement Planner Retirement Calculator Budget Spreadsheet

Free 401k Calculator For Excel Calculate Your 401k Savings

Thinking Of Investing This Is Why You Need A Financial Advisor Financial Advisors Investing Financial

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

-savings-detailed.png)

401k Contribution Calculator Top Sellers 58 Off Www Seaforthland Com

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Contribution Calculator Step By Step Guide With Examples

Here S How To Calculate Solo 401 K Contribution Limits Small Business Resources Small Business 401k Business Resources

Easy Retirement Calculator Personal Finance Retirement Calculators Personal Finance Retirement Calculator Finance

Retirement Savings Calculator

401k Contribution Calculator Top Sellers 58 Off Www Seaforthland Com

401k Calculator

Solo 401k Contribution Calculator Solo 401k